Decision-makers in banking expressed concerns about moving their operations to the cloud. This is understandable. There were recent data breaches during cloud migrations at Capital One and T-Mobile

Yet, with planning, you can avoid these mistakes and reap the benefits of cloud migration.

The Cloud Security Alliance conducted a study. They found that organizations had three times the chance of success with a plan. Also, a study by the IBM Institute for Business Value found planning reduced costs by up to 30%.

In this blog, Banks will learn from the mistakes of others during cloud migration. Banks can also modernize their IT infrastructure and maximize cloud computing. All the while not compromising the security and compliance of sensitive financial data.

- Mastering the Art of Cloud Migration: How a Detailed Plan Can Benefit Banks

The Cloud Security Alliance conducted a study. They found that lack of proper planning is one of the top three causes of cloud migration failure. Organizations with detailed migration plans were three times more likely to be successful.

This plan should include timelines, milestones, and contingencies to help manage the process. It should also include a thorough assessment of the bank’s current IT infrastructure. That way, any potential roadblocks get addressed early.

A detailed plan also helps banks to reduce costs and improve efficiency. The IBM Institute for Business Value also did a study. They found that organizations with clear migration plans reduced their costs by up to 30%.

Cloud migration allows banks to modernize their IT infrastructure and maximize cloud computing. “But, failure to plan can lead to migration failure,” says the Cloud Security Alliance.

- Navigating the Cloud: How to Choose the Best Provider for Your Banking Needs

When choosing a cloud provider for your banking needs, consider the following factors:

- Data security and compliance with industry regulations

- Reliability and scalability.

- The provider’s global network,

- Provider experience working with financial institutions

- Pricing and contract terms.

Some of the top cloud providers in the banking industry include:

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud

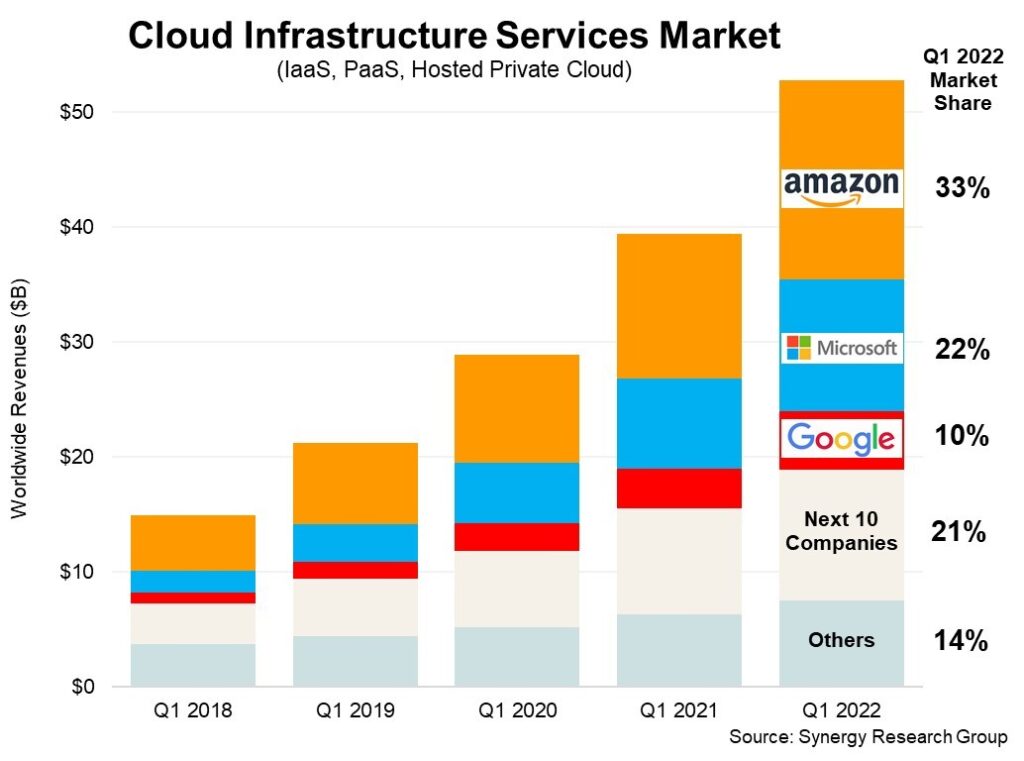

According to a 2020 report by Synergy Research Group. AWS has the largest share of the market. Their infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS), had 33% of the market share. Microsoft Azure and Google Cloud followed with 18% and 8% market shares. You can read about this research at this link.

Also, note that large banks have their own private cloud infrastructure. They manage and operate it in-house.

In the end, the best cloud provider for your needs will depend on your specific requirements. So, analyze your options. Also, a trusted advisor or consultant can help you make an informed decision.

- Cloud Migration 101: The Importance of Testing and Training for a Seamless Transition

Testing allows you to identify and address any issues before the migration goes live. This can include functional testing, performance testing, and security testing. Performing these tests verifies that systems and applications are working as expected. They also identify and address potential problems.

Another important aspect of successful cloud migration is training. Your employees should get training on the new systems and applications. This includes new cloud platforms, and new or updated software and tools. Training speeds up new technology usage in day-to-day operations.

The International Data Corporation (IDC) conducted a study. It found that organizations that test and train staff and solutions; enjoy higher returns on investment (ROI). It also indicated an average of 30% faster migration and 25% higher ROI.

In summary, testing and training are essential components of successful cloud migration. Test your systems and applications and train your employees. You will ensure a smooth transition to the cloud and a higher return on investment.

- Cloud Migration for Banks: How to Ensure Compliance and Secure Your Data

When migrating to the cloud, banks in Africa must consider the following.

- Various regulations and compliance requirements specific to the region

- Security of sensitive financial data.

The first example is the Central Bank of Nigeria (CBN) guideline on electronic banking. It requires the security and integrity of electronic banking operations. This includes having a disaster recovery plan and incident management plan. Banks must ensure that their cloud provider is compliant with these guidelines. Also, have the necessary controls in place to protect against data breaches.

The second is the African Continental Free Trade Agreement (AfCFTA). It came into force in January 2021. The AfCFTA requires the free movement of goods, services, and people, across borders. Banks must ensure that their cloud provider is compliant with this agreement. Besides, having the necessary controls to protect the personal data of African citizens.

Additionally, African banks should also adopt these security practices:

- Encrypting sensitive data both at rest and in transition.

- Implementing multi-factor authentication for access to cloud systems

- Monitoring and auditing cloud systems for security vulnerabilities

- Having a robust incident response plan in place for security incidents.

Note that in Africa cloud technology adoption is still in its early stages. Thus, banks are learning to navigate the complexity of regulatory compliance and security. African banking security experts or IT consultants are the best advisors on this.

- Maximizing Cloud Migration Success: The Importance of Monitoring and Optimizing Your Infrastructure

Monitoring ensures systems are performing and you have the resources you need. This includes monitoring key metrics such as

- CPU usage,

- Memory usage

- Network traffic

- Storage usage

Additionally, monitoring cloud infrastructure costs reduce spending on under-utilized resources.

IDC conducted a study in 2020. organizations that track and optimize their cloud infrastructure enjoy many benefits, these include

- Increased system performance

- Reduced costs

- Improved security.

These organizations enjoy a 20% system performance increase and a 30% cost reduction. But, note that the level of cloud adoption in Africa is still low, and the cloud market is new.

Furthermore, Africa lacks the infrastructure and skilled IT professionals for the cloud environment. As a result, monitoring and optimizing cloud infrastructure is a challenge.

- Avoiding Pitfalls: Common Mistakes to Avoid in Cloud Migration for Banks

Here are a few of the most common mistakes to avoid when migrating to the cloud in Africa. All the following mistakes are in this blog.

1. Lack of a clear migration plan

2. Not considering regulatory compliance

3. Failing to test systems:

4. Lack of training for employees

5. Not monitoring and optimizing the cloud infrastructure

IDC conducted a study on these mistakes. They result in 50% longer migration times and 25% higher costs. Furthermore, these mistakes cause system downtimes, data loss, and security breaches.

- Data Migration in Cloud Migration for Banks: Why it’s Important and How to Do it Right

Moving data from on-premise systems to the cloud is complex and time-consuming. But is a must for the success of the migration. Data migration helps to improve data security, compliance, and all operations.

Accenture conducted a study on data migration. It is among the challenging aspects of cloud migration. For over 60% of banks, data migration is the most difficult step. This is because of the complexities of preparing, transferring, and validating data. Additionally, dealing with data quality issues and ensuring data consistency.

To ensure a successful data migration, test the migration to ensure it is seamless. This way data is not lost or compromised.

Another important aspect of data migration is data security. This includes implementing encryption, multi-factor authentication, and other measures for sensitive financial data.

Follow the above practices, for successful data migrations. It also prevents data loss or compromise.

- Steady and Sure: The Importance of a Well-Planned Cloud Migration for Banks

Cloud computing improves operations and customer experience.

One of the other benefits of migrating to the cloud is higher scalability. With cloud computing, banks can add or remove resources as needed. They don’t need to invest in new hardware.

In Africa, there is rapid population growth and economic development. Also, the digital native market had led to increased demand for financial services.

The second benefit of migrating to the cloud is security. Banks in Africa face many unique security challenges. These include a lack of physical security infrastructure and trained personnel. Moving to the cloud can take advantage of the latest security technologies. For example, multi-factor authentication and encryption, protect their customer’s sensitive information.

Yet, migrating to the cloud is not without its challenges. One of the biggest challenges is minimizing the disruption of banks’ operations. Also, infrastructure and personnel are in place to support the move.

To cut the risk of disruption, adopt a phased approach to their cloud migration. This involves moving workloads to the cloud in stages, rather than all at once. Through this approach, you test the waters and address issues before a commitment.

Declouding: Moving Away from the Cloud

Declouding refers to moving away from cloud computing and returning to on-premises infrastructure. It is becoming a popular trend among African businesses.

Although cloud computing has benefits there are reasons why businesses choose to decloud.

One of the main reasons for declouding in Africa is the cost. While cloud computing can be cost-effective in the short term, over time, the costs can add up.

The costs of cloud computing, such as data storage, bandwidth, and maintenance, are high. Additionally, as businesses grow, they need more resources, leading to increased costs.

Another reason for declouding in Africa is data sovereignty. In cloud computing, third-party providers store and manage businesses’ data. This can be a concern for regulated industries, as they have strict data protection laws. By declouding, these businesses regain control over their data. They also follow local regulations.

A third reason for declouding in Africa is security. While cloud computing can offer improved security, it also comes with its own set of risks. Businesses worry about the security of their data housed in a third-party data center. Especially in countries where cybercrime is prevalent. By declouding, businesses take a more proactive approach to security. They store and protect their data to meet their specific needs.

Finally, many businesses decloud because they want to take advantage of new technologies. As technology continues to evolve, businesses’ initial technology can’t support their needs. By declouding, businesses take advantage of new technologies. For instance, edge computing provides more efficient and cost-effective solutions than cloud computing.

This podcast discusses reasons why 37signals decided to move away from cloud services and host their software on their own servers.

- Cloud services have been around for over a decade and many companies are starting to question their use.

- Companies with a predictable base load and a long-time horizon may benefit from hosting their own software.

- Purchasing hardware is now more affordable than ever.

Counter arguments:

- Cloud services offer simplification benefits that may be worth the cost.

- Companies with unpredictable loads may not benefit from hosting their own software.

Work with us

Looking for a reliable partner for your cloud migration journey?

Finsense is here to help with comprehensive roadmaps, support, and expert guidance every step of the way. Contact us today and let our years of experience ensure a smooth transition for your business.

Sources

- Capital One data breach: https://www.cnn.com/2019/07/29/tech/capital-one-data-breach/index.html

- T-Mobile data breach: https://www.csoonline.com/article/3480286/t-mobile-data-breach-was-caused-by-a-misconfigured-firewall-during-an-aws-migration.htmlTop of Form

0 Comments